From June 2020 to June 2021, there were 16,672 mergers and acquisitions in the U.S. alone, up 24% from the previous year. The harsh reality is that only a small percentage of these M&A deals will be successful. Culture plays a critical role in the ultimate success or failure of any M&A deal. When cultures merge, there are sure to be growing pains. You can mitigate the effects of a culture clash in mergers and acquisitions by anticipating and making a plan to overcome them – from day one.

How organizational culture is categorized

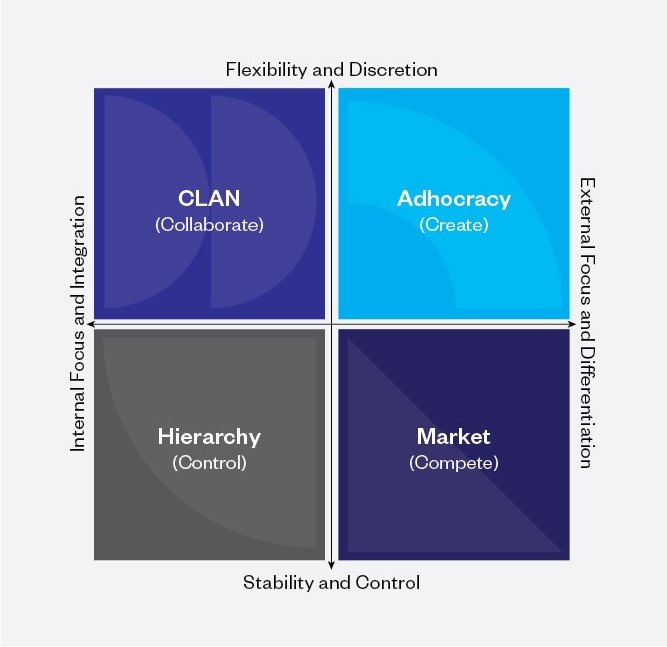

If you’ve held positions at more than one company during your career, you recognize that every organization has their own unique way of doing things. One commonly referenced model of culture has four broad categories:

- Clan

- Adhocracy

- Hierarchy

- Market

In another popular model, there are two simplified categories: tight and loose. In tight cultures, consistency and structure are highly valued. Processes are followed to the letter. In loose cultures, innovation and creativity are highly valued. Processes may or may not be defined, as they can be seen as restrictive. However, this model doesn’t encapsulate the nuanced differences in organizational cultures.

Let’s dive more deeply into the four different types of culture as defined by researchers at the University of Michigan. Using the Competing Values framework, they determined an Internal-External dimension, and a Stability-Flexibility dimension as part of the validated Organizational Cultural Assessment Instrument (OCAI).

For Internal-External, organizations usually fall somewhere on a spectrum of motivation. Do we focus our efforts on our people, internal development, and collaboration? Or are we driven by what’s happening in the marketplace, development of new technology, and customer research?

In the Stability-Flexibility dimension (which correlates closely with the “tight-loose” culture definitions), organizations are measured exactly as they sound: are they more process driven, or do they “go with the flow?”

Types of organizational culture

Clan (Collaborate)

In a clan culture, the focus is on people development and collaboration. On the two spectrums, it falls under Flexibility and Internal. The structure tends to be more horizontal, meaning that everyone from C-level executives to Customer Service Managers are able to collaborate with one another effectively and without barriers.

Ways to spot it: High employee engagement, agile environment to easily adapt to changes in the market, team-oriented mindset, and room for innovation.

What it’s missing: Scalability (when the organization grows, will this model be sustainable?), seamless operations, clear direction.

Adhocracy (Create)

This culture’s signature characteristic is its ability and willingness to take measured risks. While innovation is highly valued in adhocracy organizations as well, ideas must be informed by data and insight and tied to market growth. It is external and flexible.

Ways to spot it: High performance in the marketplace, brand recognition, emphasis on individuals’ personal development.

What it’s missing: Collaboration (this structure can often breed inter-office competition), clear direction.

Market (Compete)

In this type of culture, profitability is a key driver of culture (instead of the other way around). Bottom line is king here, and there tends to be less accessibility between leadership and employees. This culture is external and stable.

Ways to spot it: High performance in the marketplace, achievement of financial goals, unification of employees behind a shared set of goals.

What’s missing: Collaboration, innovation, employee engagement.

Hierarchy (Control)

Finally, in a hierarchy culture, stability and structure reign supreme. Think traditional office setting: everyone at their desks 9-5, suits and ties, and a clear line between leadership and those who report to them. This culture is both internal and stable.

Ways to spot it: Clear direction and objectives, defined processes.

What’s missing: Innovation, flexibility, and agility.

[newsletter_module]

How to avoid a culture clash in Mergers & Acquisitions

It’s important to note that none of these cultures are the “right” culture. There is no good or bad, and it’s all about what propels your organization forward.

It’s easy to see how merging two opposite cultures together could create differences within the new combined organization, especially where no planning around this integration is involved.

Speaking to Toolbox HR, Michele Hammil, CHRO at JAGGAER, explains that organizations should “recognize and reiterate to employees the value of the cultures both companies came from…It’s no longer one versus the other – you are creating something entirely new.” She goes on to state: “Focus on identifying the areas where the most commonality exists and building appreciation for the value of the differences that each organization brings.”

By evaluating the existing cultures of the soon-to-be-combined organizations, and determining what you want the culture to look like moving forward, you’ll limit your chances of M&A failure. This takes a great deal of attention to your existing culture, as well as the culture of the other organization. The truth is, every single organization has a culture, whether intentional or not.

Ideally this evaluation will take place far in advance of the finalization of the M&A. To start, it’s important to assess key aspects of your current culture, such as its ability to drive results, the degree to which stated values are truly believed and supported, how engaged employees feel, and more. Gather as much input as you can to ensure you have the complete picture.

Next, determine what you want your combined culture to look like. There are several ways to integrate cultures. We discuss them in depth in our eBook, Merging Cultures Through M&A.

Finally, it’s important to create a sustainable change. In an ideal culture, there are opportunities for improved results, personal employee growth, better agility, more innovation, and higher engagement. But without intentional culture management, it’s not possible to keep these changes alive.

Your M&A doesn’t have to be messy. Reach out to us to start your culture journey today.